Lets talk about the Composition Effect, and Why Employment Seems Weird

- Ray Alner

- Aug 20, 2025

- 9 min read

This is a long story, so lets buckle in and get started. You can skip to the end if you aren’t a numbers nerd, but just stick with me, its interesting, and provides a little insight into why things feel so weird right now.

The Question

At the end of each month I look at the job numbers posted by the BLS. Each month I’m disappointed it’s not showing what many of us feel right now.

Over the past two years, headline data has painted a fairly optimistic picture of the U.S. labor market: low unemployment, relatively strong wage growth, and a mostly resilient post-pandemic recovery as of writing (June 2025). Yet, for many professionals in the tech sector, that story doesn't line up with lived experience.

Generally speaking, it feels like potential high earning employees like tech workers can’t find a job very easily. Some waiting for months others (like myself) applying for hundreds of jobs with not even an interview. If you look at the reputable layoffs.fyi you will see similar massive job losses over the last few years, and somehow the job market still shows stubborn resilience, shaking off these job losses.

So what gives? How is it that on the one hand we have good economic growth, low unemployment, and solid wage growth, but on the other we have high earners struggling to find a job?

The Story

Here’s a generalization of the events leading up to today. Since there’s so many other things going on in this space at the same time, I’m going to do the ole “holding all else equal”, and we’ll discuss some of the externalities later.

If we look back to 2020-2022, the tech industry had huge growth, almost 3 times the growth of the previous years, going from 2.6m employees to almost 3.1m employees. That is just in tech, not other industries that support it, like furniture, support roles, etc. leading to a huge push for high wage tech earners and their supporting roles, like business analysts, IT support, etc.

Now, during this time, lets tell another story.

As the tech industry saw a massive boom of employment, and tech jobs become the new golden pasture where people could work from the comfort of their own homes; retail, grocers and other service based industries were seeing the flight. Wages pushed higher just to get employees to stick around in those lower wage positions. The tech vacuum had begun. Retail was out. Tech was in. Because tech was generally higher paying roles, the inflation impact was there and was definitely felt, but could be generally handled as the wages pushed higher for low income employees and could be compensated by higher income employees by changing spending habits.

Come 2023, it all came crashing down. Businesses realized they couldn’t keep this pace, and things slowed down drastically. All of a sudden the tech world started laying off people.

We saw a significant drop in tech workers as the industry reset. Looking at the layoffs.fyi, we saw about 650,000 laid off from 2023 to 2025, and growth in the tech world that moved into negative territory, seemingly overnight.

Employees were feeling the drop. Those who may have felt the impostor syndrome, felt it hard now, as what was once an employees market transitioned to an employers market, and employees had to prove their worth through strict productivity KPIs while also wading through RTO mandates.

All the while the job numbers still “look” solid.

The Composition Effect

Lets talk about my theory.

The concept isn’t new, but I haven’t seen it shared during this event frequently in the media, maybe because we’re now a half-dozen paragraphs in and just getting to the theory.

So, whats happening. Why does the economy look fine, but feel awful?

Lets talk about the composition effect. The composition effect is when the mix of the workforce changes (like high earners being removed from the data set), the remaining wage growth appears healthy, even if it's driven by growth at the bottom or middle.

For example, a $2/hour raise on a $17/hour job is an 11.8% increase. That will move the median more than a $5,000 raise on a $170,000 tech salary would. And if that $170k role is eliminated entirely? It's not dragging down the average, it’s just gone. It’s especially felt if other service roles at lower wages have greater growth.

In this case, it hides the fact that many high-wage workers are no longer counted at all once they exit the higher wage position, sometimes pivoting to lower wages to make basic payments. Since most wage growth metrics are reported as median or average increases across the entire labor force, it fails to take into consideration WHICH positions drove the increase. When high-paid workers are laid off, and lower-paid workers receive modest raises, the growth metrics can appear "strong."

The Numbers

Wage Growth

First, lets define the wage groups inside these percentiles. For example, the 1st - 25th percentile encapsulates people making up to $Xk/year. Using the data here, we can break it out accordingly:

25% - $31k/yr

50% - $41k/yr

75% - $49k/yr

90% - $60k/yr

While not ideally broken up into the same percentiles, it shows a good enough range for my analysis.

Now lets look at the hourly wage growth by percentiles.

See the breakout? Wage growth for the lower two percentile groups (25% & 50%) grew at a much higher rate than the upper two percentiles.

You can even see a little bit of the supply and demand pricing effect happen, if you look at total technology employee growth, was insane, around 2.6m people. Any basic supply and demand curve would show that those higher wage positions had wage growth lower because the supply & demand curve shifted. More employees were working at tech jobs than retail, and other typically lower paid positions, leading to generally lower wage growth in information positions. Either way, wages for information workers were (and still are) at the higher end of the spectrum.

Employment Shift

After 2022, companies in the information industry shed employees like the plague. There was a massive shift in employment across industries. Tech was out and other industries were in.

Now lets look at the highest growth sectors by employment growth.

The highest sectors of growth after 2023 were:

Education & Health Services

Health Care & Social Assistance

Construction

Transportation & Warehousing

Generally speaking, these groups tend to have lower wages than information roles.

The Wage Shift

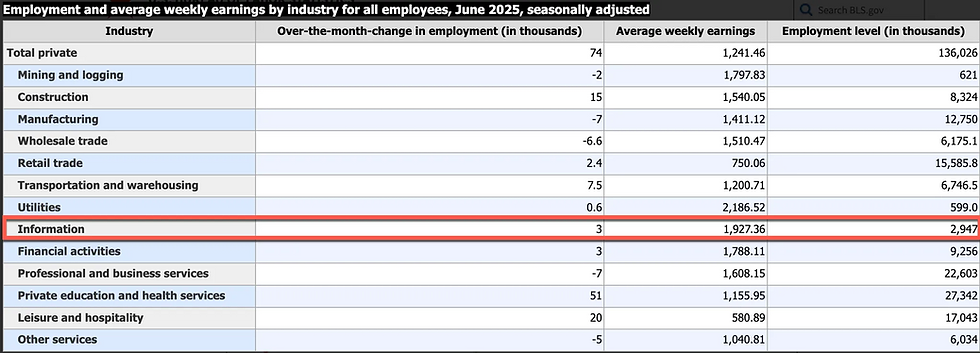

Lets now look at another shift with wages. Lets take a look at average wages for employees in the information space. On average, the earnings for Information employees was $1,927/week, or about $100,000/yr.

Now imagine over 650,000 employees leave the information space, those wages now disappear, further exacerbating the composition effect and pushing up the impact the lower wage growth had on overall wage growth.

I understand the discrepancy, with the weekly earnings and the percentile wage numbers, in that the top 90% makes $60k or more, and I’m sure more details and data could be gathered around the those wage groups, but you get the gist. Also, information industry employees are in a completely different league of pay vs. other industries.

Job-to-Job/Industry-to-Industry Flows

While some of the employees that entered the technology industry were originally part of that cohort and stayed in that cohort by finding new jobs at a new company, some move back to the original industry they may have held prior to changing to the information industry.

Still, many who were laid off struggle to return to the workforce because they may not have had sufficient experience in another industry, or became part of the composition effect by returning to a lower wage position. Add that to the fact that many employees are now staying put because of the shift to the employers market, and job switches aren’t netting the same gains as they once did.

Externalities & Observations

There’s a bunch of externalities and I’m sure more research could sus out more specific details, but the composition effect seems to be strong enough to prove that there IS some weirdness going on with why there is low unemployment, and generally good wage growth.

With that said, lets look at some externalities and other topics that we should keep an eye on, that may also have some impact on the composition effect, and explain why the job market is being weird.

AI

Well, we can all agree that AI is probably one of the biggest reasons the tech industry has shifted their employment. with generative AI, companies have jumped on the productivity pipeline, telling employees to be more efficient with AI, or straight up laying off because of the prospective gains AI will provide their business in one way or another.

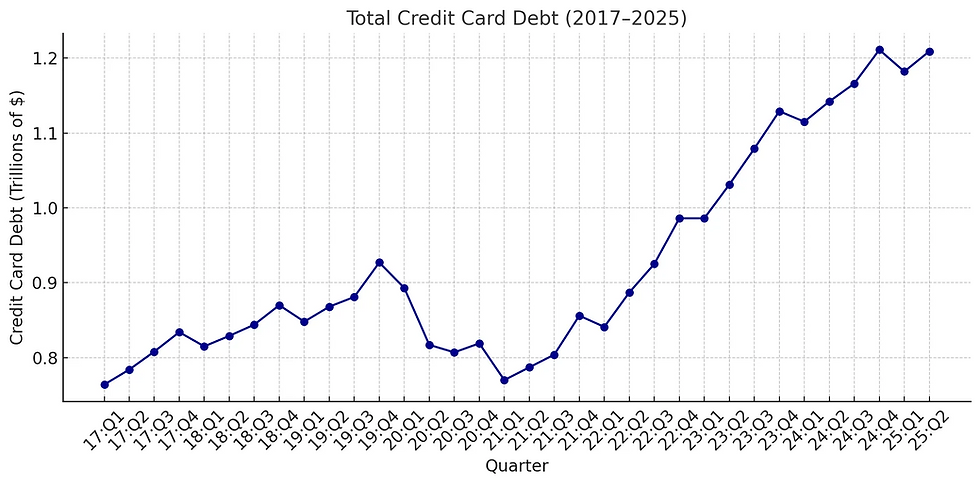

Debt

Household debt grew at faster rate during the 2022-2024 period, although is slowing down again, likely because people are changing their spending habits to match their decreasing income. Much of which could be explained by the decrease of almost 3/4 of a million people from the tech industry that was making higher wages.

There are a whole bunch of other numbers too that we could analyze, things like delinquency rates, (which is growing as well), but I think it shows enough for our need.

Innovation Spending Cuts

While spending on innovative products never slow down because, ya know, Private Equity, there was an important tax benefit that changed that I’m sure also had an exogenous effect on who spent money on innovation. According to the report, the ability for a company to deduct 100% of R&D cost in the year, must now amortize the R&D spending, leading to an estimated $12 BILLION in investment in R&D.

That, and the continuous government spending cuts on various projects that would encourage innovation, research & development, is another stake in the coffin, for a generally innovative and forward-thinking country.

Some notable changes were:

National Science Foundation cut over $1 Billion in R&D grants

Chronic underfunding of the CHIPs Act by over $8 Billion

Final Thoughts

There’s still a bunch of research that should be done, specifically in the composition effect. There are not a lot of longitudinal studies done on wage growth on specific cohorts and its affect on occupational mobility, which I’m sure was a huge part of this wild ride we had over 2020-2024.

Now as we get into the third quarter of 2025, the question is how much is the industry going to focus on one thing at a time? First it was remote work that caused the explosion in 2020-2022 and all the stuff that came with that business cycle, now it’s AI. Once AI burns out or settles in, what are businesses going to look for next? How will the composition effect change again? Will all the AI experts get let go as companies chase the next big innovation?

I look at this picture and see a lot of smart people now unemployed due to businesses chasing the next single innovation and as a result big businesses making big changes. The result is that it’s now forcing smart people to pick jobs that don’t let them use their full economic potential, while also suppressing others from joining the information industry, as well educated information workers accept lower paying entry level jobs. With over a half a million people worth of innovative people on the chopping block what was lost? What will the end result be for the economy?

I look at it this way, if companies were truly thinking of growing their revenue, why not keep employing and re-train even a quarter of what they laid off and give them AI to make them that much more productive? Skill-biased technological change has shown that the value of technology isn’t in the tool alone, but in how well it complements skilled labor. Instead of leveraging smart employees, many companies choose to cut loose experienced employees and chase new hires in emerging fields that are barely defined. The opportunity loss from not investing in upskilling their existing workforce is wild to me.

Now you have customers that are turned off of the product that caused their prices to increase and a bunch smart, active tech influencers who would have been excited about the tech they were creating or part of, but now are trying to figure out how to implement it in their own workflow, making adoption slower.

I got distracted there, but you get the gist. From what I can tell the composition effect this time is probably the most visceral and disorienting in modern history, and is clear as day. As high-earning tech jobs disappeared and were replaced by growth in lower-wage sectors, the headline numbers began to misrepresent the real experience of many professionals. Add in structural changes like AI adoption, reduced innovation funding, and rising debt burdens, and it’s no surprise the job market “feels” off. Going forward, it’s crucial to watch how these forces evolve, and evaluate a different set of economic indicators, or we will find ourselves wondering why the bottom fell out of the market as we slide down an economic canyon of our own making.

Hey! Quick Question.

I'm currently between jobs and dedicating my time to creating content here on the blog. If you've found value in what I'm sharing, consider buying me a coffee to help keep me fueled while I continue writing and job searching. Every contribution, no matter how small, means the world to me.

Thanks for reading and for any support you can offer!

Comments